how does doordash report to irs

Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. If you overpaid at the end of the year you will get some money back.

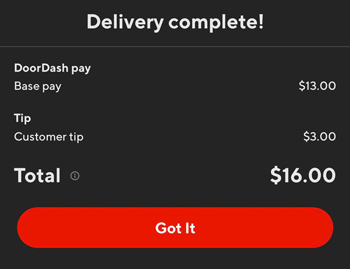

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

If you earn more than 600 in a.

. In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. If youre a Dasher youll need this form to file your taxes. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

What is reported on the 1099-K. The forms are filed with the US. You are required to report and pay taxes on any income you receive.

If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe. It doesnt apply only to DoorDash. Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed.

They have no obligation to report your earnings of. However Doordash issues a 1099 form at the end of each tax. Doordash is an independent contractor and doesnt automatically withhold federal or state income taxes.

A lot of people get the idea that Doordash is under the table work or that. Incentive payments and driver referral payments. FICA stands for Federal Income Insurance Contributions Act.

Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. Typically you will receive your 1099 form before January 31 2022. Answer 1 of 2.

If you made over 600 they will report it to the IRS. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. Yes Robinhood not only report Stocks Dividends Crypto they also report any Options Trading to the IRS.

Doordash will send you a 1099-NEC form to report income you made working with the company. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. How do i report income to doordash.

Does DoorDash Report to the IRS. Instead Dashers are paid in full for their work and must report their. Its only that Doordash isnt required.

Grubhub Uber Eats Doordash Instacart and others report our earnings to the IRS through a 1099 form. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

The 600 threshold is not related to whether you have to pay taxes. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. A 1099-NECyoull receive this from DoorDash if you received at.

DoorDash uses Stripe to process their payments and tax returns. Incentive payments and driver referral payments. Yes - Just like everyone else youll need to pay taxes.

Form 1099-NEC reports income you received directly from DoorDash ex. 2 days ago. Use a mile tracking app.

At the end of every. Does DoorDash Report to the IRS. In simple terms whether you sell a stock or receive a dividend you.

Internal Revenue Service IRS and if required state tax departments. Log into your checking account every pay day and put at least 25 of your dd earnings in savings. You do not get quarterly earnings reports from dd.

Stripe also sends 1099-Ks for. If you didnât select a delivery method on your. These items can be reported on Schedule C.

If you earned more than 600 while working for DoorDash you are required to pay taxes. Starting this year if you made more than 600 on DoorDash DoorDash will give you a 1099-K showing the gross amount of credit card payments made to you. Tough to decipher the exact question youre asking but.

You do have the. Theyll also send that form to. Since dashers are treated as.

DoorDash does not automatically withhold taxes. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck.

How Do I File Taxes When Partnering With Doordash

Doordash Taxes And Doordash 1099 H R Block

Why Doordash Drivers Get Deactivated And How To Get Reactivated Ridesharing Driver

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Data Breach 5 Things To Do If You Were Affected

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Mileage Report What S Required How Falcon Expenses Can Help Mileage Tracking Mileage Expensive

How Does Doordash Do Taxes Taxestalk Net

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash Driver Canada Everything You Need To Know To Get Started

Oops Doordash Ceo Suggests The Company Pays The Equivalent Of Less Than 6 Hour Payup

How To Do Taxes For Doordash Drivers 2020 Youtube

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash Driver Review How Much Do Doordash Drivers Make Gobankingrates

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher